“What’s the market like just now?”

It’s a regular question from clients to recruiters.

Utilising the latest data from multiple sources, here is a 3 minute update on the current recruitment landscape. (We’ve put in some nice infographics of some of the facts and figures if you don’t even have 3 minutes to spare!)

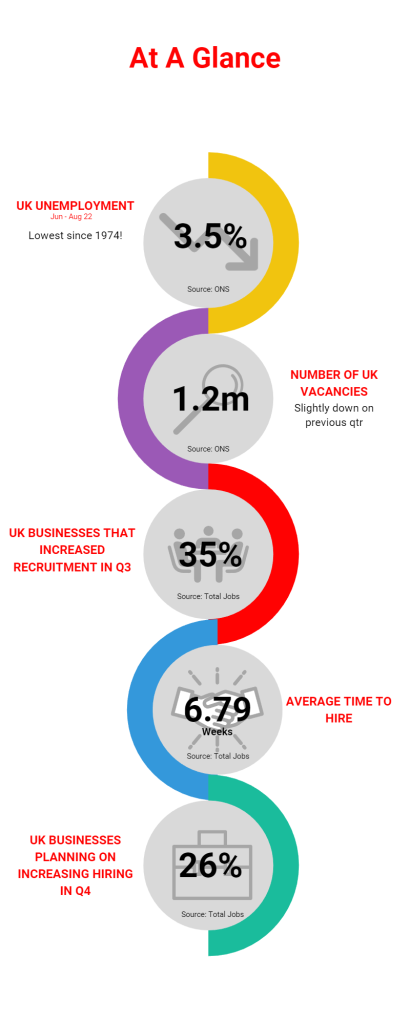

According to the latest Office of National Statistics data on employment, the UK unemployment rate for June to August 2022 was 3.5%, the lowest rate since 1974. Additionally, in June to August 2022, the number of unemployed people per vacancy fell to a record low of 0.9 so there are literally more available jobs than unemployed people in the UK!

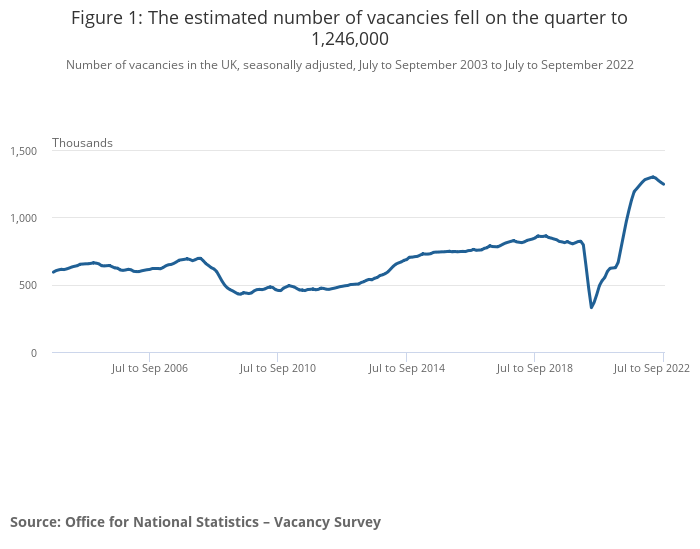

In the same July to September period, the estimated number of vacancies fell by 46,000 on the quarter to 1,246,000, which is the largest quarter-to-quarter fall since summer 2020. Despite three consecutive quarterly falls, the number of vacancies remain at historically high levels.

The UK’s inflation rate has barely been out of the news over the last few months. This is having a significant effect on wages. In real terms, UK pay has fallen by a staggering 2.4% in 2022.

Online job board, TotalJobs, recently released its quarterly Hiring Trends Index for Q3 (July – September 2022). This tells us that just over a third (35%) of UK businesses increased recruitment in Q3. If you are one of those that plans to be recruiting soon, you will be targeting the 13% of UK workers that are planning to leave their job in the next 6 months. But if recruitment is less important than retaining your current team, 52% of UK workers say receiving a pay rise in line with or higher than inflation would encourage them to stay in their current role.

A combination of the high rate of UK employment and high number of vacancies impacts the recruitment process and the average time to hire is 6.79 weeks, which is relatively high, and a slight increase since Q2 (6.76 weeks). So, the average recruitment process starting in the 1st week of November 2022, will be filled by mid-December.

Looking ahead, the TotalJobs report indicates that just over a quarter (26%) of businesses intend to increase recruitment in Q4. During the same period, almost a quarter (23%) of businesses intend to increase recruitment spend for specialist roles.

The cost of living is the biggest concern for employers (55%) as well as the effect the cost of living will have on business cost (50%), followed by retaining staff (26%), skill shortages and labour shortages (both 23%), lack of business growth (18%) inability to offer competitive salaries (17%), lengthy hiring times (17%) not being able to recruit as much as the business wants to (16%) and the lack of job applications (14%).

Finally, Talent Acquisition software provider, Workable, recently released the results of their survey ‘The New World of Work’. This is a follow up to a similar survey that they conducted in summer 2020. The purpose was to compare responses mid-pandemic to current views. The main takeaways from their survey are:

Flexible working – More than 80% of businesses surveyed have some form of flexible working – whether it’s fully or partially remote, or a hybrid working environment.

Fully remote isn’t easy – Two years ago, 1/3 of businesses said 75% of their workers could work fully remotely without disruption – only half that number think so now (17.5%). In addition, only 52.4% of businesses are fully remote now, compared to 62.6% 2 years ago.

But remote has its benefits – Talent markets have increased. If someone is working remotely, it doesn’t matter where they live. 53.3% of businesses are now expanding their job postings to other locations compared with just 30.1% in 2020.

The impact of the ‘Cost of Living’? – 56.2% of employers say compensation is growing in importance now compared with 33.3% in 2020.

If you are one of the 26% of UK businesses planning on increasing your recruitment in Q4, please get in touch with us on 01383 641 222 or email hello@canmorerecruitment.com